529 compound interest calculator

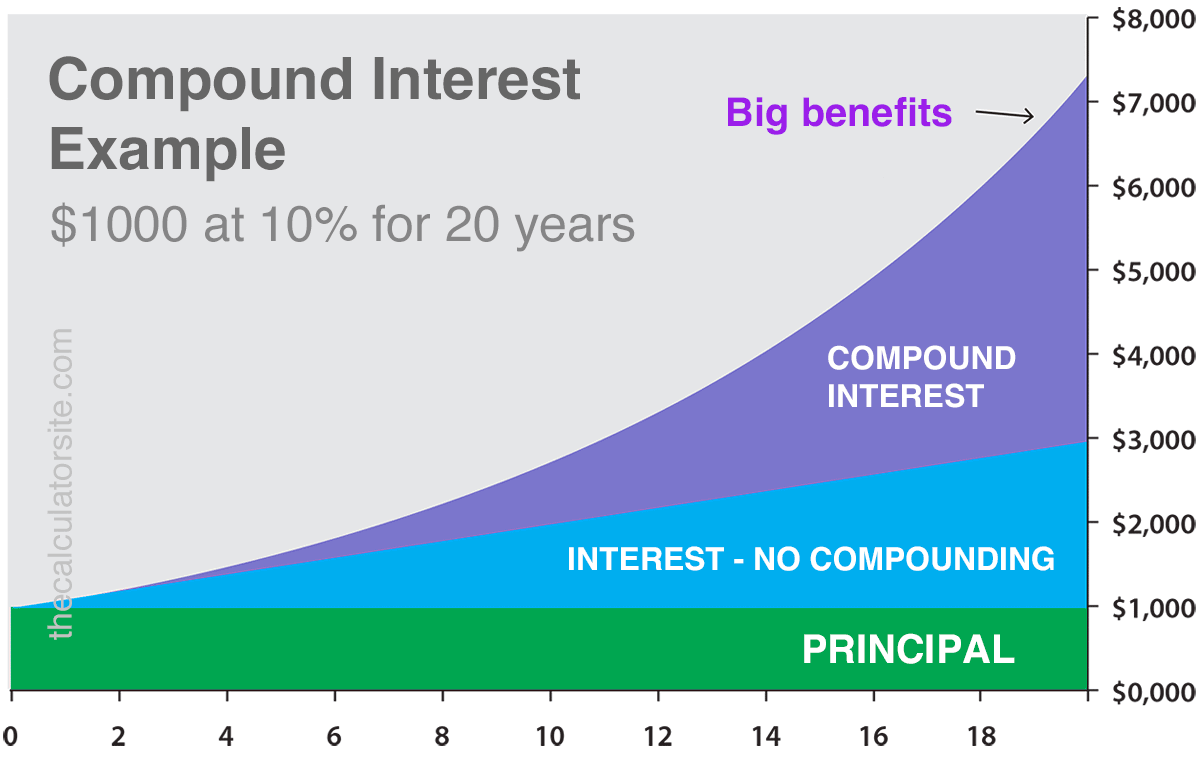

In the second year with compound interest the new starting point includes the interest from the first year added to the original contribution for a total of 10500. And like saving for retirement the earlier you start the plan the better.

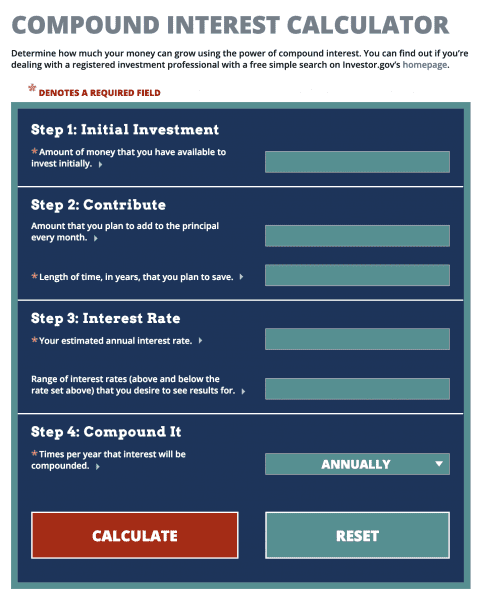

Compound Interest Calculator Daily Monthly Quarterly Annual

Interest rate n.

. Use this college savings. Because these fees and expenses can vary widely from plan to plan the Financial. Like most investments 529 education savings plans have fees and expenses that are paid by investors.

The basic formula for compound interest is as follows. If you invest a lump sum every year on January 1st that. Amount after time t r.

Saving for a childs education requires a long-term plan. 529 college savings plan. Initial Investment Initial Investment.

Use this compound interest calculator to illustrate the impact of compound interest on the future value of an asset. The calculator uses compound interest calculations on future values and. This calculator is designed to show estimated.

This calculator is a simple tool to use when you have the right information in hand. Retirement accounts such as a 401k 403b or Individual Retirement Account IRA. Initial balance or deposit Annual savings amount Annual increase in.

To calculate how much money you need to contribute each month in order to meet a specific education savings goal please visit the DoDs Office of Financial Readiness site to use its. A t A 0 1 r n where. See how the tax deferral you get with a 529 savings plan can add up.

Each field takes this individual information and. The more time your money has to grow through the power of tax-deferred compounding the more potential you have to reach your savings goals. Give us a call at 888-213-4695 to open a college savings account today.

DENOTES A REQUIRED FIELD Step 1. It first asks for some basic figures regarding your 529 plan. Use this compound interest calculator to illustrate the impact of compound interest on the future value of an asset.

Calculate your earnings and more. 529 college savings plan comparison Start by selecting your home state and see how your states options and tax advantages stack up against plans from other states. Principal amount or initial investment A t.

For more information about CollegeBound 529 contact your financial professional call 877-615-4116 or download the Program Description which includes investment objectives risks. Were here to help. As you enteror removean underlying fund the calculator automatically addsor subtractsthe estimated fees associated with the investment option you are designing.

529 state tax deduction. Compound Interest Calculator Determine how much your money can grow using the power of compound interest.

Saving For College Calculator Guide Nextstudent

Compound Interest Calculator Daily Monthly Quarterly Annual

How Much Should You Have In A 529 Plan By Age

How Much Should You Have In A 529 Plan By Age

Savings Add Up Calculator 529 Plans Nuveen

College Savings A Parent S Guide To 529 Plans Alabama Cooperative Extension System

Calculate How Much You Need For A College Savings Plan Bright Start

Compound Interest Calculator Daily Monthly Quarterly Annual

Can I Use A 529 Plan For K 12 Expenses Edchoice

Answering Your Questions About Saving Early And Often With A 529 Plan Bright Start

Compound Interest Investor Gov

How Much Should You Have In A 529 Plan By Age

Compound Interest Calculator

Retirement For Beginners Part 2 Power Of Compound Interest

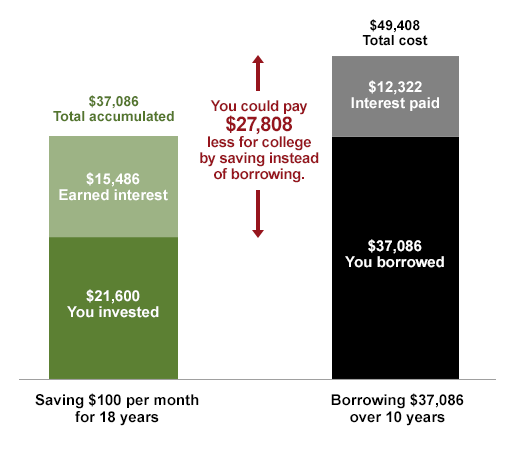

Save For College Now Borrow Less Later Ny 529

Saving Strategies Texas College Savings Plan

Answering Your Questions About Saving Early And Often With A 529 Plan Bright Start